In today’s fast-paced economic climate, having the ability to obtain financial support can mean the difference between getting by or growing. Whether you're kicking off a new startup, growing an existing one, or simply in need of responsive working capital, finding the right funding resource is crucial.

For local businesses in Florida—especially in the dynamic and constantly changing Miami market—options like business loans in South Florida and tool and hardware funding in Miami are more crucial than ever. Thankfully, there are funding partners who are familiar with the distinct needs of owners in industries ranging from retail to services.

Tailored Funding Solutions That Align with Your Business

Exploring the world of local commercial financing can be confusing. From rigid terms to one-size-fits-all conditions, many traditional lenders fall short. That’s why more and more startup founders are opting for non-traditional loans that offer not only quick turnarounds but also a human approach.

If you're a hospitality operator requiring funding for restaurants to upgrade your kitchen or enlarge your dining area—or a contractor needing equipment financing—you’ll benefit from lenders who focus on fast turnarounds, high approval rates, and flexible funding options.

A Trusted Name in Business Funding

Some companies have become well-known by doing things with care. One such example maintains a 5-star reputation across platforms like Trust Analytica. Based in downtown Miami, they extend lending across the U.S. to all types of legal businesses. With scalable loans ranging from $15,000 to $25 million and up to $2 million in business lines of credit, they are a top resource for entrepreneurs looking to grow without complications.

Whether you're in need of immediate working capital or planning a long-term growth strategy, working with a reliable financier who offers Miami business capital can make all the difference. The best partners offer quick evaluations, ensuring you receive full support at the most competitive rates—often by the same or next day.

Why Florida Startups Choose Alternative Funding

With offices located at 150 SE 2nd Ave, Suite 701, Miami, FL 33131, and a direct line at (786)-726-3236, it's never been easier for local founders to connect with professionals miami equipment lending who truly understand the local business landscape. Whether you run a popular café, a logistics company, or something in between, having access to smart business loans is no longer just helpful—it’s essential.

For business owners exploring a smarter, entrepreneur-friendly approach to lending, now is the time to consider solutions built around your success—not the bank’s. From machinery financing in Florida to restaurant capital, the tools you need are closer than you think.

Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Shane West Then & Now!

Shane West Then & Now! Mason Reese Then & Now!

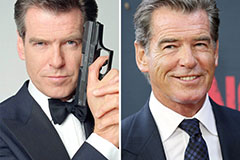

Mason Reese Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!